Three things we learned from the Asian Cannabis Report™

Article source: prohibitionpartners.com

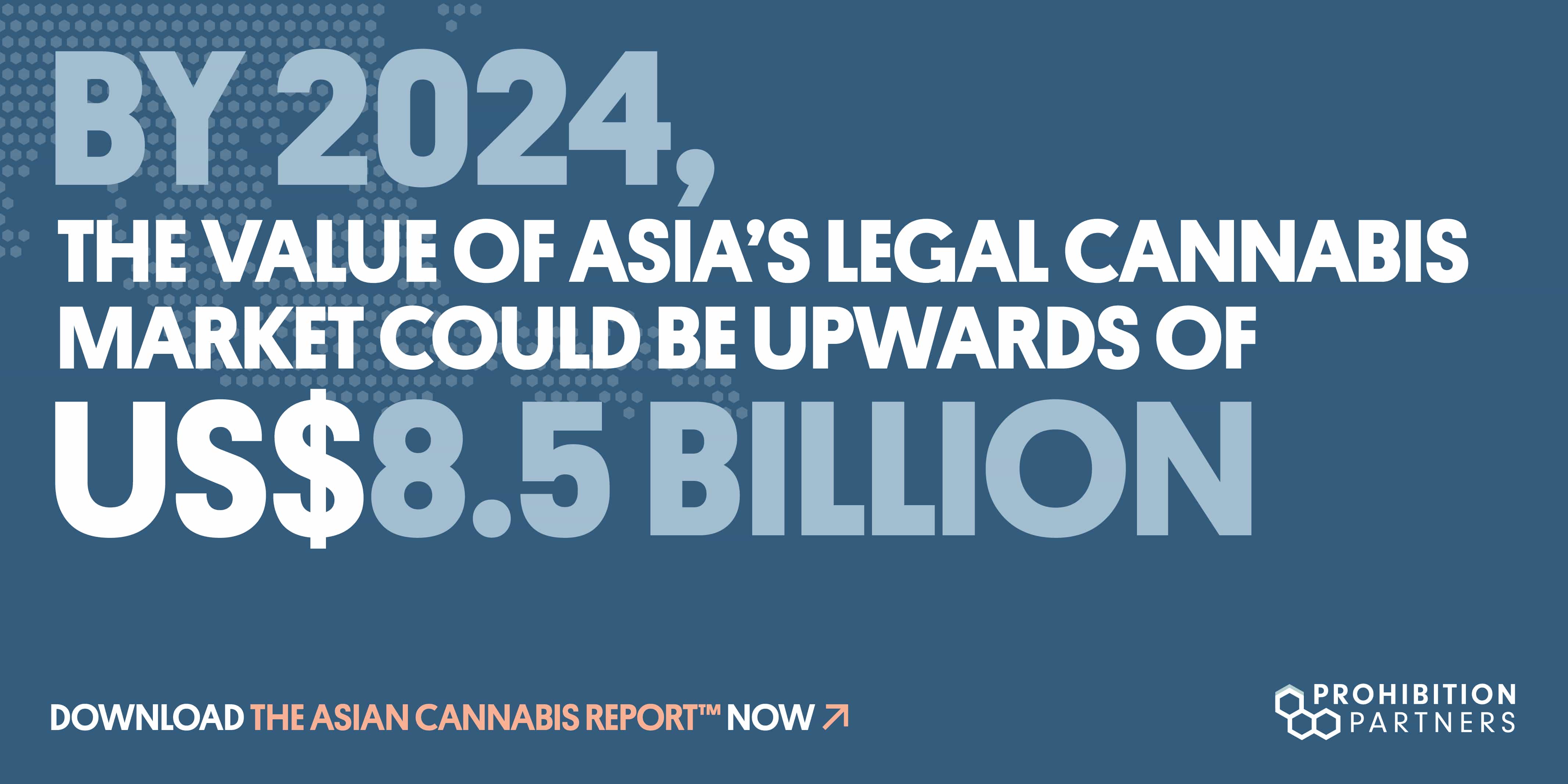

Asia’s medical cannabis market will be worth over US$5.8 billion by 2024 if a number of key markets introduce reform in the medium term. The figure comes from research gathered for The Asian Cannabis Report™, released earlier this week.

The first detailed report on the legal cannabis industry in Asia finds that the continent could reap rewards through the legalisation of medical and recreational cannabis. The Asian Cannabis Report™ includes detailed market value forecasts, regulatory timeline analysis, consumption data and healthcare analyses for seven key markets in the region.

While Asia has held conservative views on cannabis for a number of decades since the enforcement of UN drug treaties and applied political pressure from the US, the region has a historical tradition of cannabis use, often associated with Ayurvedic and ancient herbal medicines. Thailand, South Korea and Malaysia have recently introduced legalised medical cannabis under government-licensed access and research programmes and, as a result, the world’s most populous region is showing evidence of a softening stance on cannabis. As Asia has a population of over 4.5 billion and lacks a pre-existing cannabis programme, both international and domestic operators are looking at the value of this potential cannabis market.

The World’s Most Populous Region

Home to more than half of the global population, Asia is one of the world’s most valuable export markets. With a sizeable population and rising standards in education come valuable market opportunities, and the international cannabis industry is keeping a close eye on legislative developments throughout the region. At 2% of the total population, the prevalence of cannabis use is low in the region compared with all other continents. However, this is the equivalent to an estimated 86 million people, making Asia a key milestone in the long-term expansion plans of licensed cannabis producers who are looking at consumer bases beyond the increasingly cluttered and competitive markets in Europe and North America.

Cultural Ties

Cannabis has long held a place in traditional medicines across the region. In India, it has been used in Ayurvedic medicine to treat a range of conditions from blood pressure to skin conditions and glaucoma, and it is used throughout holy festivals. In fact, at 3.2% India has the highest consumption rate across the region, by a significant margin.

In China, cannabis seeds were recorded in ancient medical texts as long as 2,000 years ago, and industrial cannabis continues to boom in the region with demand surging for CBD. However, China remains strictly opposed to high-THC medical cannabis and, as such, hemp-derived CBD and pharmaceutical CBD will likely gain favour in the short-term.

Changing Tides

Cannabis was outlawed in Asia as a result of Western international pressures. Unfortunately, it is now those Western nations that are profiting from the newly emerging cannabis industry, and Asia is at the brink of being left behind in the race for market leadership.

Ironically, the increasing acceptance of cannabis across global markets, particularly in North America and Europe, may be one of the key factors behind legislative change in Asia. As global cannabis companies look for international market-share, local industries in Asia will need to protect themselves from a monopolisation of the market – a fear that has surrounded Thailand’s new medical cannabis laws

With any newly emerging cannabis market, there is both excitement and caution. China and Japan represent Asia’s two largest-value medicinal cannabis markets, worth almost US$4.4 billion to China and US$800 million to Japan by 2024 – collectively accounting for an estimated 90% share of the market. Despite this, China and Japan are unlikely to lead the way as political and social stigmas around cannabis are still pervasive. Thailand, India, South Korea and Malaysia have emerged as early pioneers in the region, but the work has only begun. Domestic markets will still need to establish open and accessible medical cannabis programmes that are fair and equitable to local business as well as need to attract the expertise of foreign cannabis firms.

To learn more about the Asian cannabis market, download our latest report: The Asian Cannabis Report™.

Back to News MMJPhytotech

MMJPhytotech