Share Purchase Plan

- Share Purchase Plan raising approximately $5 million

- Offer Price of A$0.11, being a 10.9% discount to 5-day VWAP and 51% discount to MMJ’s Net Tangible Asset Value per Share1

- Funds raised to be primarily applied towards investment in existing and new cannabis and hemp businesses, operating expenses and general working capital

- MMJ Directors who are Eligible Shareholders intend to participate in the Share Purchase Plan

MMJ Group Holdings Limited (ASX: MMJ) (“MMJ” or “the Company”), an Australian-listed company that specialises in managing a portfolio of investments along the cannabis value-chain, is pleased to announce the launch of a share purchase plan (“SPP”) to raise approximately $5 million.

SPP Overview

The board of MMJ (“the Board”) is pleased to provide MMJ’s Eligible Shareholders (defined below) the opportunity to purchase up to $30,000 worth of new shares in the Company (“New Shares”), irrespective of the size of their shareholding, without incurring brokerage or transaction costs (“SPP Offer”). The New Shares will be issued at an issue price of $0.11 per share (“Issue Price”).

The Issue Price represents a:

- 10.9% discount to the volume weighted average market price of Shares over the last five days on which sales of Shares were recorded on the Australian Securities Exchange (“ASX”) immediately prior to the announcement of the SPP; and

- 51% discount to the last announced Net Tangible Asset Value per Share as at 31 January 2020, being $0.22581.

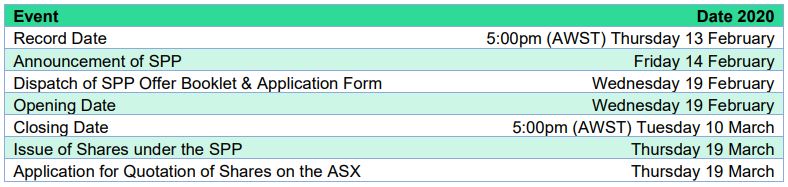

Participation in the SPP is optional and open to all MMJ shareholders registered as at 5:00pm (AWST) on 13 February 2020 with a registered address in Australia or New Zealand (“Eligible Shareholders”). It is expected that MMJ shareholders will receive the SPP offer booklet during the next week. The SPP is expected to close at 5.00pm (AWST) on 10 March 2020.

A copy of a presentation on MMJ’s operations has been separately released to the ASX.

The Company’s Directors2 who are eligible to participate in the SPP have all indicated that they intend to participate in the SPP.

In the event that more than $5 million is applied for under the SPP, the Board reserves the right to scale back applications in their absolute discretion, or alternatively, accept oversubscriptions.

Canaccord Genuity (Australia) Limited is acting as Lead Manager to the SPP.

SPP Rationale

MMJ believes that the adverse market and industry sentiment created in the past six months surrounding cannabis companies has created opportunities to invest in listed and unlisted Canadian cannabis businesses at attractive valuations. MMJ continues to be invited to invest funds into the global cannabis market in line with its investment mandate and believes that it is in the best interests of shareholders to raise equity funds so that MMJ can have improved flexibility to participate in such investment opportunities.

In addition to opportunities to invest into new businesses in the global cannabis market in line with MMJ’s investment mandate, MMJ also holds warrants (similar to ‘options’ in Australia) and contractual rights in a number of its existing listed and unlisted investments which provide opportunities for MMJ to make follow-on investments in businesses at a discount to current valuations and where MMJ is well placed to understand their potential returns.

SPP Timetable

Chairman’s Comments

Commenting on the SPP, MMJ’s Chairman Peter Wall said: “The SPP is expected to improve MMJ’s position to take advantage of the growing global cannabis and hemp market, with a particular focus on listed and unlisted Canadian cannabis businesses. It also increases our flexibility to make follow-on investments in our current portfolio companies and to manage the timing of exits for some of our existing investments.

We believe that a SPP is the fairest and most efficient means of raising equity, where our Eligible Shareholders will be offered the first opportunity to invest additional funds in the Company at a discount to the current share price. On behalf of the Board, I’d like to thank our supportive shareholders.”

Read the full ASX Release here.

1 Net tangible assets per share after tax on unrealised gains on investment portfolio as at 31 January 2020.

2 Michael Curtis, a non-executive director of MMJ is a Canadian resident and is ineligible to participate in the SPP.

Back to News MMJPhytotech

MMJPhytotech