Cannabis market primed to rebound with sales expected to hit US$23.7 billion by 2023

Australian producers are well placed to ride the next wave of growth as the cannabis sector moves beyond recreational retail products.

After a rough 2019 the Canadian cannabis sector is gearing up for a rebound over the next three years.

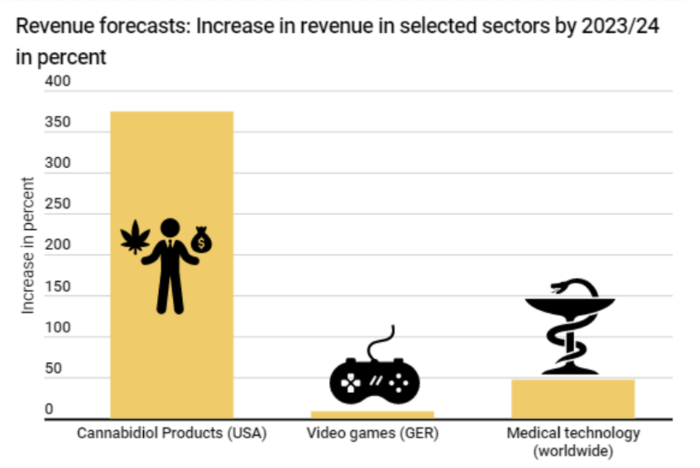

Kryptoszene.de, a cryptocurrency news and information platform has released an infographic showing the industry is expected to see an increase in sales of up to 374% until 2023.

It anticipates that in three years the rise in demand for cannabidiol (CBD) products will increase by five times.

The market is expected to turnover US$7.38 billion in 2020, US$10.89 billion in 2021, US$16.6 billion in 2022 and US$23.7 billion in 2023.

Kryptoszene analyst Sebastian Schuster said: “We are still in the early years of a professional marijuana industry.

“The market takes some time to find the right balance between a steady production on one side and good products in high demand on the other side.

“But over the coming years we will get closer to that balance.”

The infographic sets the cannabis growth expectations in relation to other markets, such as gaming and medical technology.

While the gaming industry is expected to grow 8.29% over the upcoming years, and medical technology is anticipated to grow 46.91%, neither one will come close to the expected 374% growth of the cannabis market.

Kryptoszene predicts more cannabis products across new applications like medical and skin care products will potentially find their way into the market.

Retail cannabis market

According to MMJ Group Holdings Ltd (ASX:MMJ), a global cannabis investment company, Canada is home to multi-billion dollar heavyweights like Canopy Growth (TSX:WEED) and Aurora Cannabis Inc (TSX:ACB), and has blossomed into a mature market for legal cannabis products.

This growth has largely been driven by the retail cannabis market, which differs from ASX cannabis stocks that are focused on medical applications of the plant.

One of MMJ’s portfolio companies, Embark Health, is gearing up for an initial public offering this year, and the company’s other Canadian investment Harvest One Cannabis Inc (CVE:HVT) (OTCMKTS:HRVOF) has secured a niche in both the medical and retail markets, recently divesting assets to fund the development of it’s Cannabis 2.0 product distribution.

MJJ is confident that these growing Canadian cannabis companies will benefit from the expected rebound in the sector and might bump up its share price at the same time – which is currently trading at 50% less than 31 January at 96 cents per share.

Australian medicinal products

While Canada has the legal retail cannabis market covered, Australian companies are focusing on the production and use of cannabis for medical issues.

THC Global Group Ltd (ASX:THC) is progressing towards large scale manufacture of its Canndeo medicinal cannabis product with two world-class medicinal cannabis growing facilities in Australia.

The NSW site can grow up to 600,000 plants per year, and the Queensland research and development site can produce 850,000 strain clones per year to seed the NSW grow site and up to 20,000 square metres of partner sites.

This manufacturing capability puts THC in a prime position to service both domestic patients and the export market.

The company is also aiming to commence clinical trials from the September quarter 2020.

Zelira Therapeutics Ltd (ASX:ZLD) is also developing cannabis products for the treatment of medical conditions and has developed two proprietary formulations as well as partnering with Ethicann Pharmaceuticals for the development of the CAN-001 product for the treatment of chemotherapy-induced nausea and vomiting.

Zelira recently accepted applications from overseas investors for an additional 1.08 million shares as part of a share placement which, following the acceptance of oversubscriptions, increased to $4.64 million for funding to accelerate its global product launches and clinical programs on insomnia, autism and opioid reduction.

Clinical trials and real-world evidence

Australian company Medlab Clinical Ltd (ASX:MDC) launched the NanaBis™ observational study in February at the Royal North Shore Hospital in Sydney and aims to provide evidence that is based on real-world data for safety, tolerability, use and potential adverse events of cannabinoids for the management of cancer pain.

The study recruited 2,000 Australian patients via medical or hospital settings to provide intervention data over a 12-month period.

The company is currently in a trading halt pending the release of the trial results.

Zelira is also conducting trials with Emerald Clinics Ltd (ASX:EMD) which operates a network of clinics specialised in assessing the safety and efficacy of unregistered medicines including cannabinoid medicines.

Results from the trials are expected later in 2020 and Emerald is confident generating real-world data will open an alternative pathway to expensive clinical trials for cannabis products in Australia.

With the Canadian cannabis market expected to rebound by 2023, Australian producers are well placed to ride the next wave of growth as the sector moves beyond recreational retail products.

To read more, visit: https://www.proactiveinvestors.com.au/companies/news/914435/cannabis-market-primed-to-rebound-with-sales-expected-to-hit-us237-billion-by-2023-914435.html

Back to News MMJPhytotech

MMJPhytotech